Dear colleagues and friends,

It is the time of the year to express our appreciations.

The year 2020 has no doubt brought before us tremendous challenges. Nonetheless, with your continual support and guidance, IIGF has reached many milestones. We would like to use this opportunity to highlight some of our work and achievements in 2020, and to inform you of what is to come in the next year.

As we turn the final pages to the year of the Rat, we once again thank you for your association and trust. We wish you and your family peace, prosperity and good health, and we look forward to continuing our work together in this new year of the Ox!

Happy Chinese New Year! 新春快乐!

Director General of IIGF

1. 2020 was a year of growth

2020 has witnessed the continuous growth of the International Institute of Green Finance (IIGF). Within 4 years, our team has expanded from less than 15 members to 40 full-time researchers and 16 external consultant researchers. Our research focus now includes green finance, climate finance, energy finance, green bond, ESG, healthcare finance, green Belt and Road Initiative (BRI), green trading, international cooperation, etc.

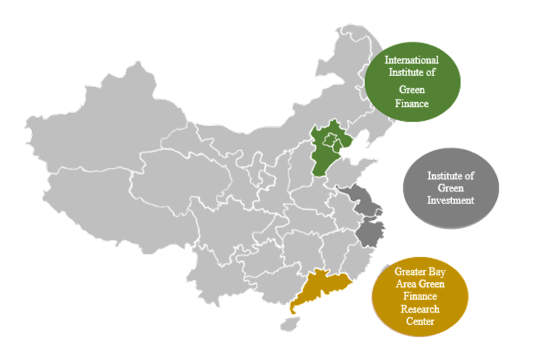

This year, we established the Greater Bay Area Green Finance Research Center in Guangzhou. Together with the Institute of Green Investment in Hangzhou, our team covers China’s major economic zones, including Beijing-Tianjin-Hebei, Yangtze River Delta, and Guangdong-Hong Kong-Macao regions.

2. Fruitful research outcomes

Academic research is our core strength. In 2020, IIGF published five academic monographs and released 15 research reports on ESG, climate finance, green bonds, and green BRI. We also published 338 opinion pieces covering different topics in green finance.

Five Academic Monographs:

- 2020 Progress Report on China’s Green Finance

- Report on the Development of China Green Bond Market 2020

- Research Report on China’s Energy Finance 2020-The Development of Investment and Financing of the PV industry in China

- Sustainability Analysis of Chinese listed banks

- Technical Report on SDG Finance Taxonomy (China) [2020 edition] (Cooperation with UNDP)

Fifteen Reports:

- White Paper of ESG Development in China 2020 (In cooperation with SINA Finance)

- ESG Credit Model 2.0

- ESG Ranking of Public Funds in China

- Sustainable Infrastructure Financing in Asia

- Healthcare Finance Report 2020

- China’s Climate Financing report 2019–“Belt and Road Initiative” Special

- Investments in the Chinese Belt and Road Initiative (BRI) in 2020 during the Covid-19 Pandemic

- Pension Finance Report 2020

- Green Urban Finance in the BRI-progress, challenges and outlook

- Case Study of the Environmental risk analysis methods

- Green Commercial Paper Verification System

- Bank Green Lending and Credit Risk (UK PACT Project; In cooperation with Oxford University)

- Green Banking in China: Emerging Trends (UK PACT Project; In cooperation with CPI)

- Green Bonds in China: The State and Effectiveness of the Market (UK PACT Project; In cooperation with CPI)

- MRV System Design: Recommendations for Chinese Green Bonds (UK PACT Project; In cooperation with CPI)

3. Driving changes through policy recommendations

Much of our research results from 2020 have been applied by practitioners. The Huzhou branch of the Industrial Bank of China has drawn on IIGF’s methodology to release China’s first environmental stress testing report in the sector of green buildings. We developed the first Green commercial paper verification system supported by the People’s Bank of China (PBoC) Nanchang Central Sub-branch.

As a think tank, IIGF strives to offer policy recommendations to support national and local governments’ decision-making processes. Together with WRI, CBI, WWF and other partners, we submitted a baseline report on Green Development Guidance for BRI Projects to the Ministry of Ecology. In 2020, we submitted various policy recommendations based on the latest studies on green finance policies, the out-break warning and detection system, ecological products, green commercial paper, small and medium-sized private enterprises financing, etc. A number of the suggestions are adopted by the All-China Federation of Returned Overseas Chinese, Local Financial Regulatory Bureau of Zhejiang, The PBoC Nanchang Central Sub-branch, Jiangxi Fuzhou Government etc.

As a third-party independent opinion provider, IIGF supports the reviewing process of the government documents. In 2020, the Opinions on the Financial Support to the Construction of Guangdong-Hong Kong-Macao Greater Bay Area (GBA), written by the Director General of IIGF, Yao WANG, and the Vice Director of IIGF Qian WANG, was submitted to the State Council of the People’s Republic of China. The opinion was discussed in the executive meeting and later adopted. Furthermore, our Director General, Yao WANG, won the 2020 Annual Special Award of Policy Recommendations from the All-China Federation of Returned Overseas Chinese.

4. Ongoing cooperation with our international partners

IIGF works closely with various partners, including the UNDP, the World Bank Group, the IEA, the OECD, the UK Government, Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ), the AFD, the ADB, the Natural Resources Defense Council (NRDC), the World Resources Institute(WRI), KR Foundation, Energy Foundation, Climate Policy Initiative (CPI), Deutsche Börse Group, ING, Oxford University, Stanford University and Global Research Alliance for Sustainable Finance and Investment, etc

In 2020, IIGF partnered with UNDP China to develop and launch the SDG Finance Taxonomy (China), and cooperated with IEA to launch the World Energy Investment 2020. Together with the Deutsche Börse Group, we hosted Sino-Europe Green Finance Summit. Supported by KR Foundation and NRDC, we kicked off our Fossil Fuel SOE low carbon transitions project. Moreover, we translated the World Bank’s report titled State and Trends of Carbon Pricing 2020, and co-authored a blog to promote it. In addition, we supported the research work at a British think-tank, Z/Yen, by contributing the Chinese Chapter at the Global Finance Index [Fifth Edition].

5. Expanding our presence

In 2020, IIGF continued to host the annual event of the Green Finance Committee, China Society for Finance and Banking, which started in 2017. Similarly, we have organized the annual event of the IIGF for four years.

This year, we promoted the Green Finance Youth Research Competition globally, receiving 101 applications from 105 universities, 10 different countries and regions. IIFG also launched events, seminars, and workshops with different partners, aiming to enhance the exchange of international green finance knowledge and practices as well as accelerate green finance development in China. Next year in 2021, IIGF will host the fourth GRASFI annual event. IIGF, along with other 25 member universities, warmly welcome your participation!

6. Contributing to capability building

In 2020, IIGF continued our efforts in green finance capabilities building for governments, financial institutions, students, and other stakeholders.

This year, under the support of UK Government’s China Prosperity Fund, we partnered with Oxford University and kicked off the project to develop a stranded asset evaluation tool for BRI countries. IIGF also collaborated with Deutsche Börse Group, Xinhua News China Economic Information Service, Wind Information and Technology Group to explore academic research applications. One example is the ESG Green Investment Guide Service Tool, which won the International Finance Forum (IFF) 2020 Global Green Finance Innovation Award. In addition, we launched an online “after – work Café” for professionals to learn about green finance through the Xiaoe-tech and Wechat platforms. The Café has hosted over 20 lectures. More than 50,000 people have visited it. Together with other research institutes in China, we organized green finance series lectures and ESG training for Chinese local financial practitioners, which attracted 5 million participants. Moreover, we supported the GIZ EMSD in developing a sustainable finance curriculum for university students around the globe. The curriculum has been carried out in Mexico. After three successful road-show courses in China, we welcome the initiative to be fully piloted in China at CUFE in the following year.Download IIGF Year of Rat Highlights:Download